New “Hybridge” (Hybrid Bridge) for Cross-Chain WHEAT Expansion: How It Works

As the launch of MOR and WHEAT on Avalanche approaches, it’s important to understand Growth DeFi’s revolutionary new hybrid bridge system, the Hyrbidge. This post is designed to address how it works and the effects it has on the WHEAT token on each chain.

WHEAT’s Hybridge is a unique, innovative concept that will revolutionize the way cross-chain DeFi is approached. It aligns incentives between WHEAT holders on different chains, burns a significant amount of WHEAT, and provides self-adjusting incentives to each chain based on market demand. In short, this hybrid launch will benefit both WHEAT holders and the protocol.

WHEAT Core Mechanics

Before diving into how the bridge works, let’s take a look at the core mechanics of WHEAT.

WHEAT is the incentives token of the Growth DeFi ecosystem. It was fairly launched (no team/development/VC/presale allocations) and anyone can farm it organically by staking tokens such as WHEAT, GRO, and MOR (among other options).

How WHEAT Earns Revenue

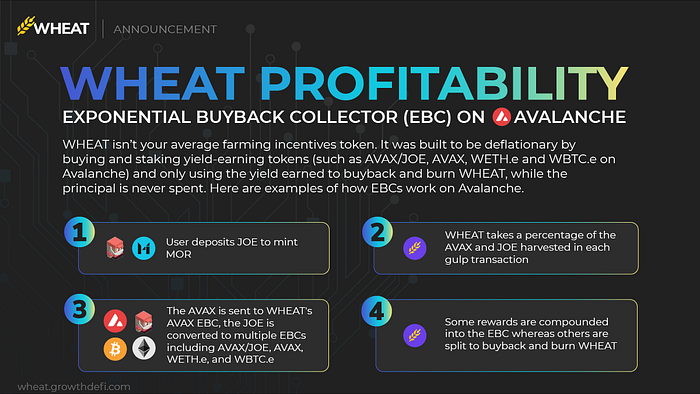

WHEAT earns revenue by charging MOR users “performance fees” on MOR’s collateral vaults. When someone deposits collateral into a MOR vault to mint MOR, the protocol harvests an ongoing performance fee on their yield that goes to WHEAT’s Exponential Buyback Collector (EBC).

The EBCs then buy revenue-generating assets, lock them up in smart contracts, and use only the revenue they generate to perpetually buyback and burn WHEAT. The staked principal is never spent. This also provides permanent liquidity to pairs such as WHEAT/AVAX or WHEAT/MOR.

Here’s an example of that process on BSC:

- User deposits BANANA to mint MOR.

- WHEAT takes a percentage of the BANANA harvested in each gulp transaction.

- The BANANA is sent to WHEAT’s BANANA EBC and is staked.

- The EBC contract uses the staking rewards to buyback and burn WHEAT. Another option for these rewards is to provide permanent liquidity to a pool like WHEAT/WBNB or WHEAT/MOR (those LP tokens would be stored in another EBC).

Here’s an example on Avalanche:

- User deposits JOE to mint MOR.

- WHEAT takes a percentage of the AVAX and JOE harvested in each gulp transaction.

- The AVAX is sent to WHEAT’s AVAX EBC, the JOE is converted to multiple EBCs including AVAX/JOE, AVAX, WETH.e and WBTC.e.

- Each EBC earns rewards (via swap fees, lending income, AVAX and JOE incentives). Some rewards are compounded into the EBC whereas others are split to buyback and burn WHEAT and to provide permanent liquidity to WHEAT/AVAX and WHEAT/MOR pairs.

A couple of things are true for the relationship between EBCs and WHEAT:

- EBC balances always go up due to performance fee inflows and self-compounding features such as lending income from Banker.

- EBCs are always generating revenue and using it to put buy pressure on WHEAT. Even if the TVL and fees for WHEAT were 0, the EBCs would still be buying WHEAT every day.

- How fast WHEAT accrues fees from the TVL in its platform affects how fast the EBCs can grow.

- WHEAT’s emissions are fixed/capped to a certain amount per block. The buyback power of EBCs only increases with time and is unlimited.

Now that we have revisited the basic mechanics of WHEAT, let’s dive deeper into how cross-chain WHEAT and the hybrid bridge works. (For those interested, there will be a separate article solely covering the EBCs’ composition, long-term trends, and how EBCs fit into the ecosystem).

WHEAT’s Hybrid Bridge: ‘Hybridge’

Until now, when projects move to a new chain, they are faced with two options — both of which are have significant downsides:

Option 1: Create A New Independent Token on Each Chain

This makes it possible to have high APYs from the start once again (on the new chain) for the bootstrapping phase. But with this setup you don’t really benefit from the project being ‘cross-chain’ (ie. your upside potential is limited to what the product on the chain you are in does, not the overall project trend across chains).

Doing this also creates conflicts between the holders of the token on each chain. If more time is spent developing products on one chain than another then the holders on the weakest chain would complain and feel left out as they stand to gain nothing from the new developments.

Overall this is a poor option that creates friction between token holders as they have no aligned incentives.

Option 2: Use the Same Token, but Split Emissions

There are several problems to this approach:

- There are no high APYs in the bootstrapping phase.

- Emissions are split, leaving fewer incentives for each chain. As you expand further cross-chain, you would end up with fewer tokens being issued as incentives in each chain — meaning APYs decrease, as do TVL and fees.

- It doesn’t allow concentrated bets. Imagine if you’re extremely bullish on WHEAT on Avalanche and not so much on the BSC side (or vice versa). You would want to take a more direct bet for your preferred chain but can’t do so since some of the emissions are allocated to other chains.

- There is no automated way to adapt incentives. Ideally, you want to have more incentives on the chain that has the highest demand for the products. However, with this option, the amount of emissions for each chain is fixed and doesn’t take into account that one chain may have more demand than another. It leads to poor incentives allocation.

This option is slightly better than option #1, but it faces substantial problems when it comes to bootstrapping a flourishing ecosystem on a new chain. In addition, the more chains that are adopted, the fewer WHEAT can be used as incentives for each chain. The lack of adaptability due to fixed emissions creates structural problems, too.

The ‘Hybridge’ Solution

Now that we have discussed the two main options that have been used by all projects in the past, let’s discuss Option 3; the option WHEAT is taking. Let me introduce the Hybridge:

There are few rules to how it works:

- Each chain has a different WHEAT with similar daily emissions: WHEAT (BSC), WHEAT (Avalanche), WHEAT (Fantom), etc.

*The daily emissions for each chain would be around 3k WHEAT/day (it can be slightly higher or lower depending on the block speed of the chain — as WHEAT are produced on a per-block basis).* - Fair launch, always!

- 90% of emissions goes to farmers

- 10% goes to the Hybridge

- 0% goes to team/development/presales/VCs/whatever other funding mechanism you can imagine.

Only a very small amount of WHEAT is added to the liquidity pool at launch to smooth it out. Taking Avalanche as an example it’d look like this:

- The starting supply of 100 WHEAT is paired with AVAX for liquidity. This is the same amount as 48 minutes of emissions; the only purpose of it is to smooth liquidity providing throughout launch day.

- ∼3k WHEAT (Avalanche)/day in emissions: 2.7k for farmers, 0.3k for the hybrid bridge.

3. The Hybridge fee is updated regularly to match the USD price differences between WHEAT across chains.

- This is by far the most important part. Users can swap WHEAT from BSC to Avalanche and vice-versa, but the exchange rate is based on the USD prices of each token.

Real example:

WHEAT (Avalanche): 100$ each

WHEAT (BSC): 3$ each

Avalanche-to-BSC bridge:

In this case WHEAT (BSC) is worth less USD than WHEAT (Avalanche), so the minimum exchange rate would be applied which is a 5% bridge fee. This means that users can swap 1 WHEAT (Avalanche) for 0.95 WHEAT (BSC). They have no incentive to do so given the price differences, but it is possible to do so.

BSC-to-Avalanche bridge:

This is where things get interesting. In this case, WHEAT (BSC) is what’s known as the “weak chain” because the WHEAT price of that chain is lower than that of other chains (i.e. Avalanche in this case). Following this example, WHEAT (BSC) is worth 97% less USD than WHEAT (Avalanche) so that 97% would be the bridge fee.

Arbitragers — or any users — would be able to swap 100 WHEAT (BSC) and get 3 WHEAT (Avalanche). Note that 97 WHEAT (BSC) was the bridge fee charged and it is burned, so that only 3 WHEAT (Avalanche) come into circulation on the other side. The total supply of WHEAT across chains decreases significantly when one chain is much stronger than another.

As explained above, roughly 10% of emissions on each chain are used to fund the Hybridge . (That’s roughly ∼300 WHEAT [Avalanche] per day in the case of the Avalanche Hybridge.) This is the maximum amount that can come into circulation from people bridging WHEAT from other chains.

If this amount were to be used fully with the 97% bridge fee, then 10,000 WHEAT (BSC) would be bridged per day, burning 9,700 WHEAT (BSC) (roughly 3 times as much of the daily emissions in this chain) and WHEAT (Avalanche) holders know that the amount that can come into circulation from this bridge is capped.

The Hybridge Fee would be updated regularly to reflect the change in price. For example, if the exchange rate goes from 33.333 WHEAT (BSC) : 1 WHEAT (Avalanche) to 20 WHEAT (BSC) : 1 WHEAT (Avalanche), then the bridge fee would be lowered to 95%. That way, arbs continue to be generated. Conversely, if the ratio goes from 33.333 WHEAT (BSC) : 1 WHEAT (Avalanche) to 50 WHEAT (BSC) : 1 WHEAT (Avalanche) then the bridge fee would be increased to 98%.

7 Benefits of WHEAT’s Hybridge

- Supply Reduction via Arbitrage. The “weak chain” burns a ton of its supply — sometimes even higher than its emissions — purely from arbitrages. This creates an easy scenario for the price on the weak chain to catch up since it becomes fully deflationary via growing EBCs on its chain and endless buy pressure.

- Cross-Chain Incentives Realignment. If WHEAT (Avalanche) performs well, then WHEAT (BSC) holders benefit greatly as a result of bigger burns. If WHEAT (BSC) performs well, then WHEAT (Avalanche) holders benefit greatly too from the substantial burns. This effect is replicated across all chains: for example, people bridging WHEAT (BSC) to WHEAT (Fantom), then bridging WHEAT (Fantom) to WHEAT (Avalanche), and so on.

- Supply Reduction via Hybridge Fees. If you’re bullish on a particular chain you can just buy WHEAT on that chain. The amount of extra WHEAT that can go into circulation from other chains bridging is always capped at 10% of emissions. But the potential of how much can be burned from users bridging over WHEAT from your chain to another is uncapped and can alone wipe out months or years worth of emissions.

- Chains Can Swap Earning Bridge-Burning Benefits. Chains can flip from strong to weak and vice-versa. When a chain is in a weak spot for awhile, it has favorable conditions in terms of EBC growth and supply reduction. This makes it likely to pump, giving it the option to flip other chains and become the ‘strong’ one. When this happens, the cycle repeats (the now ‘weak’ chain — previously ‘strong’ — can start getting the benefits of substantial burns from bridging).

- Self-Adjusting Incentives. Unlike with Option 2 from earlier, there is no need to figure out how much emissions to allocate to each chain since the market will do it for you. If the market is bullish on one chain and believes WHEAT should trade higher, then the USD incentives will be higher on that chain. Remember, the USD value of incentives is WHEAT emissions per day * USD price on the chain. Conversely, if the market thinks a chain doesn’t need many incentives, the price of WHEAT there will be lower — leading to a lower USD incentives value compared to other chains.

- Exceptionally High APYs. At the launch of WHEAT on a new chain there is no bridge (there is a grace period of a few weeks to accumulate emissions for the hybrid bridge and then fund it with the corresponding bridge fee). Given the nature of fair launches this allows anyone to participate and farm WHEAT from day one, benefitting from daily returns as high as hundreds of % per day in WHEAT autocompounding on day 1 (as close to infinity APY as it gets!).

- Increased Yield-Generating Assets. EBCs on each chain continue flowing in, accumulating revenue-generating assets in their contract, and buybacking the WHEAT on their chain. The huge burns caused by the hybrid bridge allow them to grow faster because it keeps the token supply either neutral or deflationary, which makes the EBCs have a greater effect with their buy pressure.

Final Thoughts

WHEAT’s hybrid bridges are an innovation that will revolutionize the way cross-chain DeFi is approached. It accomplishes having aligned incentives between WHEAT holders on different chains, burns a significant amount of WHEAT, and provides self-adjusting incentives to each chain based on market demand.

We are extremely excited to continue this journey expanding cross-chain and increasing our product offering with EBCs and self-repaying loans with MOR.

If you want to learn more stay tuned for more Medium articles and join our Telegram to ask any questions you may have.